How will Brexit affect the wine trade in the UK? Consumers, producers and retailers all stand to be affected. Even teetotal taxpayers have a stake.

Wine matters

The UK is at the heart of the global wine industry – it’s the sixth largest wine market in the world and the second largest trader in wine by volume.

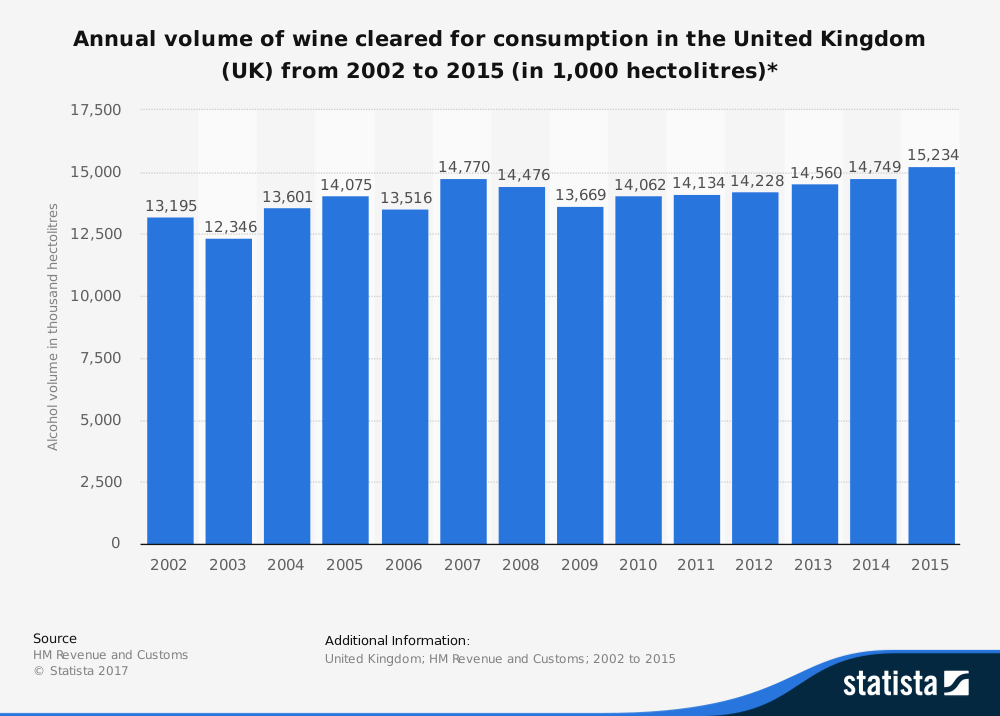

We consume about 15 million hectolitres of the stuff. That’s 2.6 billion pints in old money. The WSTA attributes £17 billion of economy activity in the UK to wine. It contributes £9 billion to the public purse every year.

As I write this, Brexit negotiations continue and the outcome is not clear. But the prospects for the wine industry are not good.

(Full disclosure: I voted remain and, with a Dutch father and a Romanian partner, I feel as much European as I do British. But I’m writing this as objectively as I can, with reference to those pesky experts and with a professional interest in the outcome.)

Brexit and English winemakers

We produce 4.5 million bottles of wine a year in the UK from 470 vineyards and 135 wineries. This includes some very high-quality producers, such as Nyetimber. The industry is already on an upswing.

If imported wine costs more, because of increasing tariffs or exchange rate fluctuations, they can look to grow their market share and perhaps command higher prices.

Jancis Robinson suggests that Brexit may give ‘English wine the opportunity to step out of its niche and establish itself as a real player in the mainstream UK wine market’.

But let’s put that production in context. Here’s a partial list of countries that produce more wine than the UK: Jordan, Latvia, Malta, Egypt, Madagascar, Luxembourg and Japan. There are single companies that produce more wine than the whole of the UK.

Even if they doubled production – and it would take years to plant and mature new vineyards – English wine producers would still only account for 1% of UK consumption, according to research by the University of Sussex and Chatham House.

There are also downsides to some forms of Brexit. For example, many British vineyards are reliant on labour from the EU for harvesting and the possible end of free movement will increase costs.

In short, Brexit will not turn the UK into a wine-producing powerhouse.

Free trade future?

One possible outcome of Brexit is a policy that prioritises free trade by eliminating as many tariffs as possible. This is the ‘Hong Kong model’.

But even allowing for the possibility that Australia, New Zealand and the USA might be able to export to the UK with lower tariffs, assuming they could secure new free-trade agreements, that would only reduce the price of a bottle of wine from those countries by about 13p a litre, which is the average tariff on non-EU wine imports to the UK.

Compare that to the £3 of excise duty per litre and 20% VAT imposed by the British Government and it’s just a rounding error.

Bottoms up Brexit

In short, we’re not going to see a surge in English wine production or a massive drop in the prices of non-EU wines. So much for the potential upside of Brexit for wine producers and consumers.

What about the downsides? Brexit may impact the wine trade negatively in three main ways:

- Exchange rate fluctuations. The Pound has dropped since Brexit and this has made wine imports more expensive. The ability of producers, distributors and retailers to absorb a 10-20% hit is limited. As forward currency contracts and pre-Brexit stock runs out, prices will have to increase.

- Tariffs. In the event of a ‘hard Brexit’, the UK would need a new trade policy which may involve joining the WTO and setting new tariffs for wine imports. Some commentators, including Jancis Robinson, have suggested these might be as high as 32%. Ouch. Others think that the rates may be set at the same level as existing imports to the EU.

- Reduced choice. The EU has trade agreements with wine-producing countries such as Australia, South Africa and Chile. These will all need to be renegotiated on a bilateral basis. This may happen quickly or it may happen slowly but, under WTO rules, the UK can’t start negotiating these deals until it leaves the EU so we may see less new world wine on our shelves and it may cost more in the meantime.

Counting the cost

Kym Anderson and Glyn Wittwer – Australian academics who presumably have no political axe to grind – have produced a thoughtful analysis of the impact of Brexit on the wine trade for the UK Trade Policy Observatory. They modelled three different scenarios and concluded:

In the main scenario considered, for consumers in the UK the price of wine in 2025 is 22% higher in local currency terms than it would be without Brexit, the volume of UK wine consumption is 28% lower, and the value of UK imports is 27% lower because of Brexit.

It’s still too early to know for sure if we’ll be toasting a bright future or drowning our sorrows. But the auguries are not good and the ongoing uncertainty cannot improve the situation.